How Energy Bars Became America’s Favorite Snack Food

When outdoor athletes launched the first energy bars more than 30 years ago, no one could have predicted it would revolutionize the way Americans eat. A look inside the hottest—and strangest—category in natural foods.

New perk: Easily find new routes and hidden gems, upcoming running events, and more near you. Your weekly Local Running Newsletter has everything you need to lace up! .

In 2003, Beryl Stafford and her daughter Alex (nickname: Bobo) decided to do some baking on a rare dreary day at home in Boulder, Colorado. Rifling through the cupboards, they found the ingredients for oat bars. The next morning, young Bobo backpacked some of the bars to school to share with friends. Meanwhile, Stafford, a single mother with a latent entrepreneurial bent, brought a dozen to a local coffee shop to sell commercially. When she stopped back into the Brewing Market a few days later, all the bars were gone and the shop requested more. Good stuff—except Stafford, who was a home baker and not a trained chef, hadn’t even been working from a recipe. Still, friends had long told her that she should sell her baked goods, so she pieced together another tray from memory, and was born. It was Stafford’s first foray into business.

Over the next 13 years, figuring things out as she went, Stafford grew ���Dz���’s to a $9 million company with national distribution. In 2015, she hired a 20-plus-year veteran of the natural-foods industry named T.J. McIntyre to take over operations. In less than three years, he nearly tripled revenues to $22 million. That bump allowed the company to raise $11.75 million in capital while increasing the workforce from 40 to 160 employees. ���Dz���’s just opened a second bakery in January 2019, which has already quintupled the brand’s manufacturing capacity and has the potential to increase it tenfold. Today ���Dz���’s is experiencing some of the fastest growth in the natural-foods marketplace. “It’s been an overnight success story,” McIntyre told me, setting up the classic small-business joke, “15 years in the making.”

Which, if you think about it for a second, is weird. Humans have been eating oats for some 33,000 years, and oat bars aren’t new. Stafford’s base concoction—oats, sugar, fat—isn’t dissimilar from a Quaker Oats cake recipe that first appeared in 1908. English-style flapjacks are pretty much the same thing and date back to at least the 1930s. And Nature Valley’s original granola bars first hit store shelves in the 1970s.

What’s more, there’s no broader cultural oat trend that would seem to explain ���Dz���’s success. If anything, Americans are currently anti-carbohydrate. But Americans don’t cook as much these days, and a ���Dz���’s bar, wrapped in clear plastic and adorned with endearing type and a smiling cartoon woman pulling a tray out of the oven, looks more like something your nanna could whip up than the old-school industrialized vibe one gets from a Nature Valley bar. To many consumers, it looks like something new. And fresh.

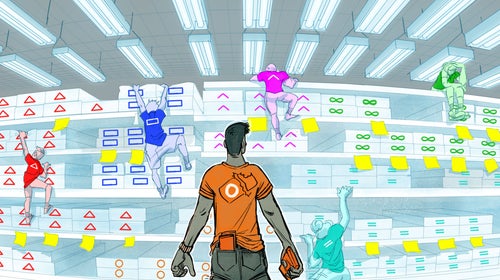

More important, bars themselves are hot right now. Depending on how you categorize snacks in bar form, the market hovers around $5 billion globally. Next time you find yourself in your favorite natural grocers on the hunt for Peruvian chia seeds and California oat milk, take a detour down the bar aisle and stop to take it all in. Carefully laid out in front of you are upwards of 35 brands and 150 individual products: Clif, Epic, Kind, Larabar, Luna, Picky, ProBar, RX, Tanka, Skout, Soyjoy, Taos Mountain, Zing—perhaps dozens more. Although these bars are sometimes barely distinguishable from one another if you remove the wrappers and serve them on a platter, they’re each carefully positioned to target a specific desire among consumers: breakfast, protein, vitality, paleo diet, women’s nutrition, gluten-free diet, and meat (yes, meat), to name a few.

You’ll notice I didn’t include “performance.” Today the myriad iterations that those original sports energy bars birthed are no longer just supplements for the endurance crowd—they’re meals in themselves. “The category started with outdoor athletes, but it expanded,” says Clif Bar’s former senior vice president of brand marketing Keith Neumann. “In terms of growth, bars are unparalleled. It’s the fastest-growing segment in the grocery store.”

Depending on which store’s aisle you visit, you might still spot the original PowerBar, which debuted in 1986. At the time, it was a revelation for sports nutrition. Prior to its arrival, hikers ate GORP (good old raisins and peanuts) or Snickers bars. Alpinists chased such snacks with warm liquid Jell-O from thermoses—the original energy gel. Skiers kept frosted Pop-Tarts in their parkas. And mountain bikers fared a little better, with bananas and fig bars. PowerBars, which were full of corn syrup and fillers, weren’t exactly healthier. But, you couldn’t wrap a banana around your handlebar in a race or jam three into a backpack without fear of sticky entropy.

Like me, a lot of outdoor athletes ate hundreds of PowerBars during the dawn of portable sports nutrition. As with hydration drinks, PowerBars were utilitarian products—supplements. They didn’t taste so hot, so we weren’t as tempted to snack on them at home. But the early bars were always in the drawer, with shelf lives built for distance, ready for a ride, run, hike, or an expedition. The brand was no small success: PowerBar was sold to Nestle in 2000 for a reported $375 million.

Beginning around the time of that sale, however, endurance athletes largely transitioned away from eating bars during exercise when faster absorbing energy gels and, later, gelatin blocks, hit critical mass—the original GU dates to 1993. But somehow the bar business only grew. It turns out that consumers were eating the squares of sweet carbs in place of breakfast or lunch.

Prior to its arrival, hikers ate GORP or Snickers bars. Alpinists chased such snacks with warm liquid Jell-O from thermoses—the original energy gel.

No company was as responsible for accelerating that trend as Clif Bar, which was the first to make energy food look and taste more like real food. The brand is currently the biggest player in the energy-bar space and one of the key drivers of innovation. Clif began in 1990, in typical bar-maker style, when founder Gary Erickson (he named the company after his father, Clifford) first baked himself some imperfect homemade energy snacks because he couldn’t stomach yet another PowerBar—a symptom known as bar fatigue in the industry. Settling on more natural ingredients was Clif’s first innovation. Unlike PowerBars, which had the look and feel of ancient taffy, Clif Bars had identifiable ingredients, making them a more natural fit in health-food stores. You could see actual carrot flakes in the company’s carrot cake flavor. But it was in 1999 that Clif displayed an eerie marketing prescience. That’s when Clif launched , marketing the new creation specifically to women. The success of that launch helped usher in the trend of more targeted offerings. Dozens of niche competitors and new start-ups responded with that slew of energy bar cousins.

A passionate cyclist at the time of Clif’s inception, Erickson surely had no idea that so many Americans would eat his bars when they weren’t exercising—or even preparing to exercise. Today, though, 75 percent of American bar consumers eat them as a snack and 60 percent replace a traditional breakfast with the more portable option. Moreover, 30 percent of Americans say it’s hard to prepare meals, given their busy schedules. The target consumer is also a marketing VP’s dream. Bar eaters have an above-average likelihood of being both young (under age 45) and wealthy (with a college degree and a household income of $150,000). Clif’s Neumann calls the trend of eating bars to replace meals “the snackification of the way we eat.”

If you want to understand just how far bars have evolved from sports nutrition, a good place to start is with Kind, now arguably the second-biggest player in the bar market. Kind originally stood out from the competition not by offering research hyping its effectiveness as athletic fuel, but by simplifying its ingredients even further than Clif: nuts, whole grains, sugars, and seeds. And it made a point of showing those ingredients to consumers. The brand’s clear cellophane wrapper actually makes Kind bars go stale more quickly, but the visuals were a key innovation. A Kind bar’s chocolate is largely on the bottom and the nuts and seeds are up top, gleaming beneath a light sugar glaze. While it’s true that a Kind bar is mildly better for you than a candy bar—it’s made from real chocolate, and there’s way less sugar and no nasty fats—its chocolate offerings are essentially deconstructed Snickers for people who care about what they eat.

Today you’ll find Kind bars in hip grocers and coffee shops, but also in the nutrition desert that is an Interstate-80 truck stop in Wyoming, where they’re gobbling up market share from mainstream candy and granola bars. “The big brands are crashing,” says Errol Schweizer, the former vice president of grocery for Whole Foods and current board member of several natural- and packaged-food companies. “Younger people eat differently. And whether they’re retail buyers or consumers, they buy accordingly.”

Traditional sports-nutrition companies are capitalizing on all that snacking, too, but to do so, they’re quietly straying from the performance-first product design. Which makes sense, considering the global market in energy gels and chews is a business only worth $25 million to $70 million. (It’s apparently so small that nobody really keeps track; the range comes from company estimates.) As evidence of the redirect, see Clif’s fairly new Nut Butter Filled bars. Most athletes couldn’t stomach that much fat when training hard or racing, but perhaps exercise fuel isn’t the point. Like a Stuff’d ���Dz���’s bar or a Kind Healthy Grains bar slathered in peanut butter, the stuffed Clif is a meal replacement. (The chocolate peanut butter flavor runs 230 calories with 11 grams of fat.)

Clif’s Neumann calls the trend of eating bars to replace meals “the snackification of the way we eat.”

Even Honey Stinger, which built its business by marketing honey-based energy gels, chews, and stroopwafels to the endurance crowd (Lance Armstrong was an early investor and spokesperson), appears to be making a move into snack food. Last spring, the company sent me half a dozen of its new Cracker N’ Nut Butter bars. Think organic nut butter sandwiched between light crispy wafers drenched in dark chocolate and sprinkled with salt. Think delicious—too delicious to be a sports supplement in my mind. I ate all six at my desk in two days while I was trying to get down to race weight.

When I called Honey Stinger, I questioned the amount of sugar (the almond butter version has 13 grams) and pointed out that the Cracker N’ Nut Butter’s chocolate would be a hot mess in your jersey pocket on a warm day. At first, Stinger insisted it was marketing them as energy bars, because they deliver carbs, sea salt, and nut butter. But the company has since changed the positioning. “I wouldn’t pigeonhole them as an energy bar or a snack bar or a nutrition bar,” says the brand’s marketing director Sara Tlamka. “If you’re hungry and you want to eat it as a snack, it’s great. It’s a recovery bar, too. It’s kind of this universal bar.” Meaning it’s a candy bar, too? I asked. Sure, why not, was Tlamka’s response. “A lot of people run ultramarathons and mow down Oreos. We have requests here at the Stinger races for soda and chips on course. [Some racers want] fat and sugar. We’re finding our own niche with it. It’s not like any other product from our competitors.”

OK, maybe it is all those things. But what these products demonstrate is that unless you want to remain steadfastly focused on gels, blocks, and waffles ����������ҳ� does, the science of sports nutrition is no longer moving the needle. That, too, is understandable, given that bar fatigue has predictably been followed by gel fatigue and block fatigue. “The early energy products were science experiments,” says Schweizer. “Today you mostly see that type of product in a GNC or online.”

Back in the early 1990s, David Ingalls was a recent college graduate running his own T-shirt company. It was stressful work, and Ingalls found himself worn down with chronic-fatigue-like symptoms. Doctors ran tests but never offered any real help. So Ingalls did research, changed his diet, and eventually removed gluten and cut way back on sugar. It worked. His energy returned and he went back to school to become a dietitian.

Later, as a practitioner, Ingalls’s clients (many with high-stress careers in the Seattle tech world) complained of similar symptoms borne from too much cholesterol and sugar. Ingalls and his coworkers tried to help, but people in such jobs have a hard time eating healthy even when given a plan. Wasn’t there a healthy product with the right mix of protein and plant-based fats in snack form? There wasn’t. So in 2010, Ingalls and three fellow registered dietitians teamed up to make one. After some back-and-forth with a co-packing facility—they didn’t whip up their own like Beryl Stafford or Gary Erickson—the was born.

A Zing Bar is possibly the most nutritionally complete grouping of ingredients you can get into a storebought bar. Think nut butters and dark chocolates and vegetable-based proteins with tapioca mixed in for fiber. As for sugar, most flavors are at or below nine grams per serving. Ingalls sent me home with a dozen assorted flavors. Given that they were designed by nutritionists, I thought they’d taste like the science experiment Schweizer described, but Zing Bars are actually pleasant to eat. Not a lot of real-food texture or visuals, but tasty like a candy bar without the rush of sugar. Far better than the dreary, dry-whey-tasting protein bars I’ve brought on backcountry ski trips.

You would think, given the rise of natural-food grocers and consumers, that Zing would be primed to be the next meal-replacement bar of choice. But the company has had a hard time standing out from the crowded marketplace of 20-odd look-alike bars. Zing came into the market with a clear sense of how to position itself: the nutrition story, which is promoted directly on the label with phrases like “Complete nutrition tastes amazing” and “Created by nutritionists.” Today, almost eight years in, Zing is a $5 million brand with a strong following in a few key markets like Seattle and Colorado’s Front Range. It has the support of hundreds of dietitians, a passionate social media following, and a cool spokesperson and investor in New York Knicks star Kristaps Porzingis. But, says Ingalls, “We started out as a nutrition bar and it didn’t do the brand justice. People want nutrition, but they aren’t willing to compromise on flavor. We should have led with the taste story.”

“People want nutrition, but they aren’t willing to compromise on flavor,” says Zing Bar’s David Ingalls.

Contrast that story with a wildly successful brand that launched in 2012. Its product isn’t all that different from Zing’s—nuts and dried fruit are dominant. Swap out RXBar’s egg whites for Zing’s vegan protein powder, and the products are pretty damn close. But RXBar did a better job of marketing the ingredients with its simplified line “3 egg whites, 6 almonds, 4 cashews, 2 dates, No B.S.” right on the spartan packaging. And with bars, messaging matters. What’s more, Zing, which altruistically wanted to help all people snack better, didn’t laser-focus on a target audience like RXBar, which found a natural following among protein-hungry CrossFitters. Bypassing the grocery store at first, RX’s founders essentially went door-to-door selling their product to CrossFit gyms who, in turn, agreed to sell the bars on consignment. In 2017, RX sold 105 million bars, generating $130 million in revenue. In 2018, founders Peter Rahal and Jared Smith sold their company to Kellog’s for (cough, hack, sputter) $600 million.

Hoping for a reboot, in January 2018, the Zing team further simplified the ingredients (cutting sugar still more, so all bars are nine grams or less), updated the packaging (less cluttered graphics and simple icons for gluten-free, vegan, and the like), and rebranded Zing as a “vitality” bar to get away from “nutrition.” With a 20 percent increase in sales in the year since, it seems to be working. But replicating RXBar’s meteoric success is still a longshot. “For the first ten years in the natural foods industry,” says Ingalls, “I was able to bootstrap it. But now there are so many brands and so much competition that you need that marketing budget.”

The old model worked from that common bootstrapping storyline: you identified a problem, baked a solution, built a loyal following, and then you tried to catch the eye of a natural-foods scout known as a forager. Whole Foods (which declined to participate in this story) was once famous in the grocery world for this aspect of its business. A regional or store-level forager would seek out or stumble upon a tasty item made locally that they thought might have some national potential. Perhaps a single store would bring it in on a trial basis. The local company’s founder would show up and hand out bite-size samples. And if the stars aligned and the whey wasn’t too cloying and, most important, the product moved off the shelves, before they knew it they’d won the lottery. “The best example is ,” says Schweizer. “It started in one Whole Foods store. Took three years to get to national. And [wait for it] it only took six or seven years to become an overnight success.”

Whole Foods under Amazon, says Schweizer, has shifted its business away from the forager model as it has simultaneously reduced the numbers of brands and SKUs in the bar aisle. This has probably streamlined the process for the retailer, says Schweizer. But it’s fundamentally changed that get-rich-quick-in-15-years scheme—and made getting on the aisle much more competitive.

The new model, if there is just one, is more macro. As the natural-foods industry grows, venture-capital and private-equity money from foodie-start-up hotbeds like San Francisco, Boulder, and New York flows in. Now, says Ingalls, the strategy is to ignore a national or even regional or multiregional approach at first, and instead focus on growing the brand hyper-locally—one city or town or target demo—so that you can skip the slow-growth schtick and, like a software developer with a new app, jump directly to the cash-infusion stage. “You put all your resources behind creating a following, proving that the product has appeal,” says Ingalls. “And with that data and loyalty, you approach a private equity firm and say, ‘this is our model.’ If it doesn’t work, you might scrap it and start over with a new idea. They’re essentially using the local market as a focus group for their pitch. Every new brand you see at Whole Foods now has a private equity fund behind it.”

Errol Schweizer, the former vice president of grocery for Whole Foods, still believes that with the right product, a home baker can still find a way.

Schweizer disputes the idea that the new model is the only model, and he still believes that with the right product, a home baker without a huge cash infusion can still find a way. He points out that the natural-grocer model is the norm now, not the exception, and those smaller chains are eager to find the next big trend, too. “And, by the way,” he adds pointing to , the Oregon grains company, as an example of a brand that is neither small nor large, “not everybody gets to grow up to be president. If you have a niche, you can stay there.”

Still, there’s no question that capital is king for any new bar entering the category. One reason: the best marketing is the free handout—and “free” is an expensive strategy. Clif is famous for doling out millions of bars at ski areas, bike races, and trade shows. Now, in yet another example of the bar industry moving away from sports performance, it’s shifting the tactic to include events where young bar eaters congregate, expanding its outreach beyond traditional outdoor activities like skiing, biking, and running. “The lens is broader today,” says Clif’s Neumann. “We attend more lifestyle events, like music festivals and even entrepreneur gatherings. And we’re just as likely to be aligned with registered dietitians as we are with pop culture influencers.”

Taking it a step further, I’ve seen Kind representatives show up on random days at busy trailheads in Colorado to hand out product. And when Kind launched its new Kind Protein bars this year, it mailed product samples to potential customers with its competitors’ product in the box—so it could win its own taste test. Brilliant, if not a touch more Machiavellian than “kind.”

Clif won out over PowerBar for the same reason that fresh-squeezed orange juice wrecked Tang: consumers wanted a product that looked and tasted more like real food. Today, RXBar and Kind are doing that to the entire bar category. But if the future of bars is real food and meal replacement, ���Dz���’s may be well-positioned to become the next breakout success. Its recipe is as stupid simple as both those products, but unlike its competitors, a ���Dz���’s bar makes you feel sated—like you just ate a bowl of oatmeal. McIntyre told me his goal is to build ���Dz���’s into a $100 million company.

One afternoon he led me on a bakery tour in Boulder while the company was hitting the market with new flavors (the pumpkin spice is damn good) and new products (I would eat the toaster pastries for breakfast), all tied to the baked-oats theme. What struck me—beyond the fact that the company bakes everything on site—was how simple the process is. The oats, coconut oil, and sugar go into a 100-gallon mixer. A baker fills a tray with the batter. Another baker smooths the batter with a spatula. A third places the trays in an oven. Minus the giant mixer and hair nets, I’ve baked oat bars at home in pretty much the same way. “Our original ���Dz���’s Bars are relatively expensive and large,” says McIntyre. “But there are consumers that look at our bar and see the 380 calories—the same as a bowl of yogurt and granola—and know that they aren’t going to be hungry five minutes after they eat one. A Kind bar isn’t going to get you there. We’re unique in that we can actually replace a meal.”

The snackification of the country doesn’t mean we have to eat like hipper versions of Cold War–era astronauts.

McIntyre gave me about a dozen bars as I left the bakery. I ate them in lieu of my morning oatmeal when I had rides planned. The bars aren’t as comforting as a steaming bowl of oats, but with a hot beverage they’re close. In the context of the market, a simple British flapjack in cellophane is actually pretty refreshing—even if I’d rather make my own. “A brick of oats was new,” says Schweizer, who saw ���Dz���’s potential when he was a global buyer. “It wasn’t pixie dust. ���Dz���’s had been kicking around for a long time, but then it synced up with a growing consumer trend: millennials and postmillenials want natural and organic, transparently produced foods. More than that, they want real food. They want stuff that looks and tastes like it came out of the ground.”

That, though, hints at a logical fallacy with the bar-as-meal trend. The snackification of the country doesn’t mean we have to eat like hipper versions of Cold War–era astronauts. As utilitarian and portable nutrition, bars will always have their place—like on a chairlift or on a five-hour mountain bike ride. And as someone who has reported on nutrition, it’s undeniably a good thing that people are eating foodie bars instead of halloween candy. Having interviewed so many of the founders for this story and others over the years, I also believe that Clif, Honey Stinger, Zing, Kind, and the crew at ���Dz���’s all want the best for their consumers. But though I routinely skip a formal lunch in favor of exercise, too, when I’m back at the desk I’ll snack on an apple with almond butter, or crackers with sardines (I work alone), or something leftover from the meal we cooked at home the night before. With bars ever evolving to a more streamlined list of ingredients, why skip these simple real meals in favor of something that came in a wrapper?

Maybe in the future we’ll come full circle. At least that’s the way my diet is trending. If I need quick energy on a bike, I drink Untapped’s straight maple syrup. For a slower burn, it’s bananas and figs. Oh, and a pocketful of nuts. I once went on a hard-charging predawn ski tour in the Wasatch. Everybody forgot to bring food, and we were bonking as we skinned up the final climb. That’s when someone in our group found some old almonds in their jacket. Nobody starved. We could see all the ingredients. And they were way easier to share than a bar.