Successfully producing outdoor gear used to be such a simple endeavor: make great product, then sell it through retail partners, or directly through a catalog or your own store. These days, the formula has become a lot more complicated. With the option to distribute through a suite of channels—specialty retailers, big-box retailers, directly to consumers via ecommerce and/or your own storefronts, through Amazon’s vendor central or Amazon resellers—brands must pull off a delicate balancing act and juggle a network of relationships to get their gear into customers’ hands. The good news? This swirl of channels also presents an opportunity to reach consumers wherever they are, telling a vibrant brand story while enhancing the shopping experience like never before. Over the next few weeks, OBJ’s special series The Outdoor Brand Playbook will take a closer look at best practices for vendors in an increasingly omnichannel world.

The Challenge: Finding Ways to Support Your Dealer Network

It’s one thing—a great thing—for vendors to refrain from trying to undercut the wholesale side of their business. But the truly enlightened take it a step further and actively help their retail partners make the sale. Highlighting stores that carry their product locally, boosting retailer marketing, training employees how to sell the gear: it all adds up to a stronger brand by putting the consumer first.

“Every opportunity that a brand can take to make it more convenient for the end consumer to find that product, [it should],” said Kristen Carpenter-Ogden, founder of Verde Brand Communications and host of its Channel Mastery podcast. “The short-term, margin-taking mentality—that’s what’s killing everyone. Look at the longer view: here’s what my consumer needs, and I’m going to make it easy and fun for this consumer to find this product.” The key truth behind this perspective: most people still prefer to shop in brick-and-mortar stores (as we’ve previously reported in this series, ecommerce accounts for only 10 percent of retail sales overall).

So vendors who don’t push customers to their neighborhood gear shops could be missing out. It starts with a brand’s own promotional materials, noted Rich Hill, president of Grassroots Outdoor Alliance. “Highlight your retail partners in all your printed materials, especially if you have a catalog,” he said. “Make it obvious the product is available in the local market.” Brands can also encourage dealers to do the same thing by giving them brand-specific marketing materials for the area, from physical displays to shareable content for newsletters and social media.

Vendors should even virtually tap customers on the shoulder when they’re browsing a brand’s website to make sure shoppers know about local buying opportunities, said Christian Gennerman of 180 Commerce. Technology that allows brands to share a store’s inventory data (like the Locally platform) makes it easy to spotlight neighborhood stores with a specific product in stock on the brand website. Vendors should also “use the inventory feeds from their retailers when the brand is out of stock,” Gennerman said. “[Tell customers] ‘You can buy from one of our retail partners.’”

The opportunities don’t end when a brand has successfully enticed a shopper into a specialty store, either. Vendors that set up in-store clinics or training sessions on selling their technical products empower employees to confidently and competently introduce them to consumers. After all, educated, passionate clerks on the sales floor pointing shoppers to that perfect pack, boat, or tent for their needs is the cornerstone of the specialty retail experience—and exactly the kind of thing that builds a devoted customer base.

The Fix

Devote time and resources to developing a retailer support strategy. Consider ways to get shoppers in the doors of local dealers—say, “’Hey, customer, here are five options for you to buy my product,’” advised Mike Massey, founder of Locally and owner of Massey’s Outfitters—and ways to help employees sell gear once they’re inside.

The Strategy

Enabling customers to discover the brand’s gear in stores extends from marketing to person-to-person training.

>> Help them help you Supply marketing content that dealers can use to promote specific products or the brand itself. Platforms like Promoboxx streamline the process, letting retailers access a brand’s marketing campaigns and tweak them to fit local needs, or pull posts from Facebook or Instagram and push them across the store’s own social media, such as the Free Fly Apparel post by Half-Moon Outfitters, below.

>> Get them wired Dealers don’t have the software necessary to share inventory data? Help them get it. “By keeping an awareness of inventory, there’s an opportunity to help everybody sell this product,” said Gennerman.

>> Be smart about store education Not every piece of gear requires a how-to-sell clinic, said Hill: “Brands like NEMO need to be cliniced, because they’re technical. I look at a NEMO sleeping bag and I don’t know what the gills are for. Their tents require setup.” The more differentiated gear is from other product, the more it needs in-store training. But be careful not to let clinics devolve into “casting shade on other brands,” noted Hill, as the retailer is trying to sell that gear, too.

>> Spread the wealth Consider putting a price tag on retailer support and share profits with your dealers, as Leki does (below).

Case Study: Leki

When ski and trekking pole brand Leki branched out into a direct-to-consumer sales channel, leaders had concerns about the effect the new business would have on its dealers. So Leki decided to go beyond traditional store support and actually cut retailers in on website sales about five years ago, said U.S. vice president Greg Wozer. The brand partnered with the MWRC ecommerce company (which stands for Manufacturers, Wholesale, Retailers, Consumers) to run the website’s shopping cart.

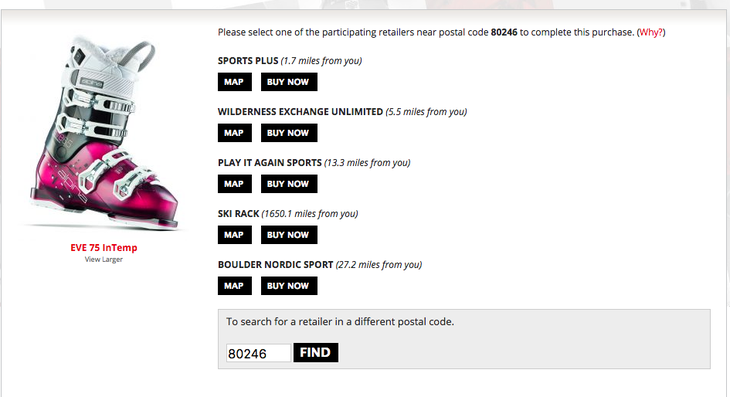

Here’s how it works: when customers click “Buy Now” on the Leki website, they’re prompted to enter their zip codes. “It immediately shows them five retailers within a 50-mile radius of where they are,” Wozer explained. “Then they have to choose a retailer to share the revenue with.” Leki fulfills the order out of its warehouse, then sends the chosen retailer a notice, including the customer’s contact information for potential follow-up. Every month, Leki pays out (in dollars or credit) 25 percent of the full retail selling price. “The retailer didn’t have to buy the product, stock it, or price it,” he added. (The website’s functions are currently being updated, but Leki plans to have these online tools back up and running before Outdoor Retailer Summer Market 2018.)

A quarter of the brand’s online revenue doesn’t add up to huge profits for dealers, Wozer acknowledged—last year, Leki spread about $40,000 across roughly 1,100 retailers—but it’s not meant to. The brand still wants customers to buy directly from retailers, Wozer said, and increasing local kickbacks would mean that DTC was becoming a larger part of Leki’s business. Plus, the program is meant as a goodwill gesture. “Honestly, we’ve built our business on the backs of the specialty retailer,” he noted. “Not only are they business partners, a lot of them are friends. I would have had a hard time looking these guys in the eye at the trade show if we were working to take business away from them.”

Wozer said some retailers still aren’t quite sure why the Leki credit shows up on their paperwork, but others write the company thank-you notes. And instead of avoiding retail partners at Outdoor Retailer? Sometimes Wozer gets a pat on the back.